1.Coinbase CEO says Trump is excited about creating a Bitcoin reserve.

Coinbase CEO Brian Armstrong stated in an interview that President Trump is excited about establishing a strategic Bitcoin reserve.

“The world is moving towards a Bitcoin standard. Any government holding gold should also hold Bitcoin as a reserve asset.”

2.12 U.S. states are pushing for the Strategic Bitcoin Reserve Bill.

according to Cointelegraph reports, 12 states in the United States are actively pushing for the Strategic Bitcoin Reserve Act. Including:

·Florida, Alabama, New Hampshire;

·Pennsylvania, Ohio, North Dakota;

·Oklahoma, Texas, Wyoming;

·Massachusetts, Utah, Arizona.

3.Trump’s Presidency May Boost Cryptocurrency Investments.

according to Techinasia report, Coinbase CEO Brian Armstrong stated during his participation in the World Economic Forum in Davos, Switzerland, that President Trump’s term in office could drive an increase in cryptocurrency investment.

Brian Armstrong suggested that the support of leaders in major economies such as the United States could have a significant impact on the market. He believes that Trump could become a supporter of the crypto industry and emphasized that public support can influence industry development. Legislative changes in Congress could drive new investments in cryptocurrency, and he mentioned that part of Bitcoin’s recent high was attributed to Trump’s inauguration.

4.Stablecoins’ market cap nears $213 billion, a new record.

According to Defillama data, the total market capitalization of stablecoins across all networks is approaching $213 billion, hitting a new all-time high. It is currently reported at $212.89 billion, representing a 3.02% increase over the past 7 days.

Notably, the total market capitalization of USDC has surged by 11.23% in the past 7 days.

5.DOGE and TRUMP ETFs May Launch by Early April.

Bloomberg ETF analyst Eric Balchunas posted on social media regarding the “Rex filing for a DOGE ETF and TRUMP ETF” incident, stating that these ETFs are both applications made under the 1940 Act, so (in theory, if not rejected) they could potentially be listed in early April (75 days after the filing).

Reportedly, Eric Balchunas is referring to the 1940 Act, which regulates asset management and derivative products portfolios. Applications filed under this act also benefit from a streamlined 75-day review process. By leveraging this process, the DOGE and TRUMP ETFs could be listed ahead of other filings (such as XRP and Solana ETFs), which need to undergo a cumbersome 240-day review process under the 19b-4 filing rule.

6.TRUMP’s Actions Unlikely to Impact Bitcoin Reserve Plans.

At the Davos World Economic Forum, Coinbase CEO Brian Armstrong stated that his acknowledgment of TRUMP’s “explosive” behavior would not be a hindrance to Bitcoin’s strategic reserve, and he does not believe it has damaged any aspect of Bitcoin’s strategic reserve. The efforts made by the crypto community remain effective. U.S. Senator Cynthia Lummis is also championing this idea to become a reality.

7.Ethereum Gas Fees Reach $2.48 Billion in 2024, Leading Blockchain Revenue.

according to data released by CoinGecko, Ethereum ranked first in the blockchain leaderboard in 2024 with a $24.8 billion Gas fee income, followed closely by Tron with $21.5 billion, and Bitcoin ranked third with $9.2289 billion.

The report pointed out that in 2024, Layer 1 and Layer 2 blockchains received a total of over $68.9 billion in transaction fees, with Layer 1 on-chain income being $66 billion and Layer 2 on-chain income $2.9492 billion.

8.Lido Founder: Ethereum Second Foundation Not Yet Established.

Lido founder Konstantin Lomashuk stated in a post that “there is currently no real second foundation established. Ethereum is the ultimate world computer, and every Ethereum supporter can help it grow, evolve, and succeed. If a second foundation is really formed in the future, it must have a clear goal that complements the huge work of current contributors.”

Thank you for your support. I also believe that we need more organizations to contribute to Ethereum. I will further share my thoughts after communicating with those who have contacted me.

9.VanEck Executive Supports Ethereum Second Foundation.

VanEck’s Director of Digital Asset Research, Matthew Sigel, retweeted the “Ethereum Foundation Tweet” on social media and expressed support, stating that there is no reason to believe that the Ethereum Foundation is the sole entity that can shape Ethereum’s future.

10.Vine Founder Launches Cryptocurrency with $18 Million Market Cap.

Rus Yusupov, one of the founders of the short video platform Vine, announced on the X platform that VINECOIN has been launched on pump.fun and released a video to confirm that his account has not been compromised.

As of the time of writing, the token has a market cap of over $180 million within 2 hours of trading, with a trading volume of $135.7 million.

Earlier, BlockBeats reported that on January 19, Musk replied to a tweet saying that X is considering reintroducing the short video sharing platform Vine.

It is reported that Vine was a short video sharing platform originally operated by Twitter. Vine was initially an app that allowed users to shoot and share 6-second looping short videos, and it became popular for its extremely short duration, creativity, and viral spread.

Vine was founded in 2012 and acquired by Twitter in the same year. After its official launch in 2013, it quickly became a popular short video platform. However, due to business strategies and other reasons, Twitter shut down Vine’s core services in 2017. Information indicates that Rus Yusupov served as Vine’s Creative Director, with advertising and design experience. He has been involved in the company’s operations since Vine was acquired by Twitter.

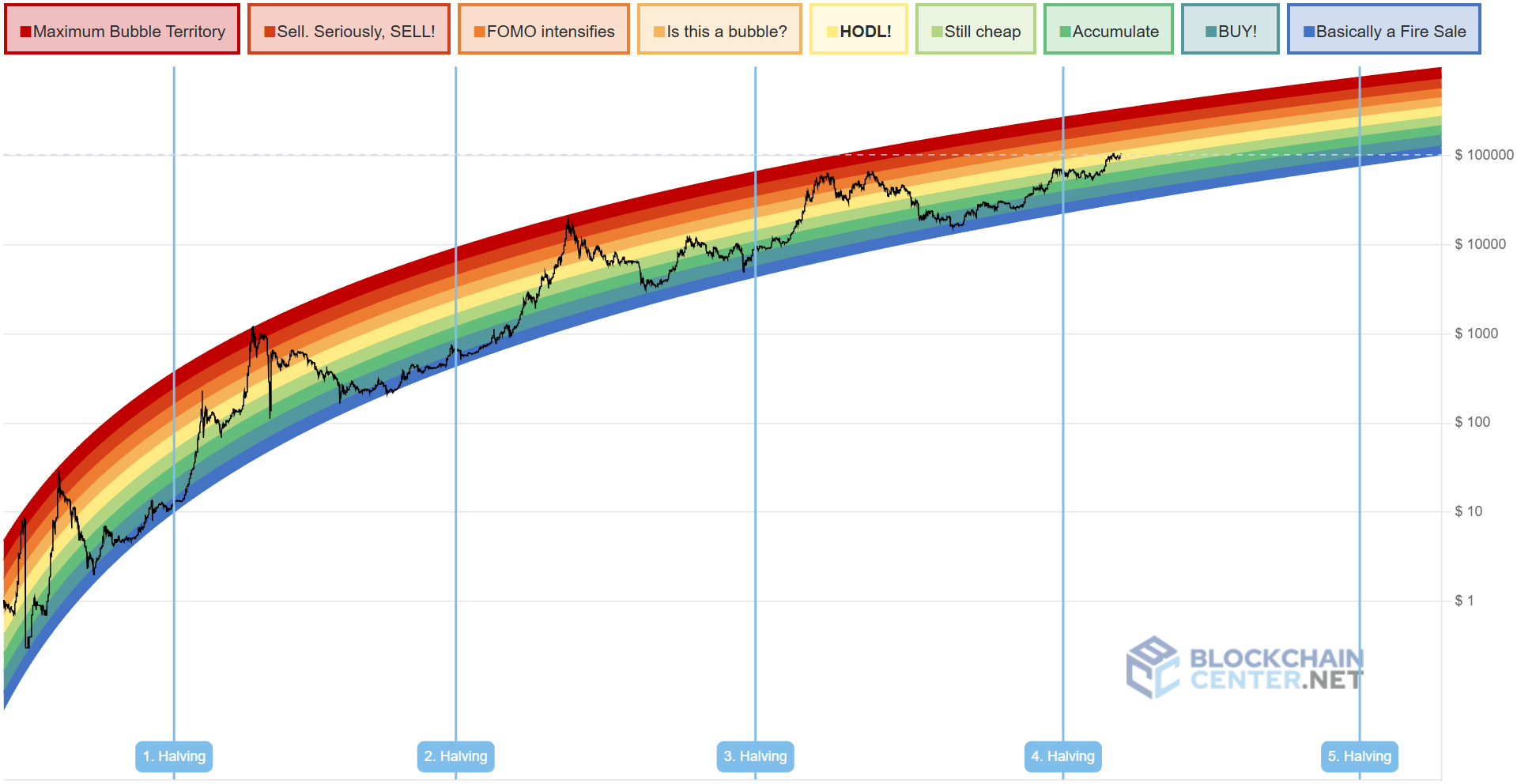

This chart takes price movements of the past 1,458 days and repeats those movements again to predict the price on each day over the coming 1,458 days. It also displays the previous after-halving top price as well as the tops after each upcoming halving.

Comment79